Our Research

Learn more about our research. Engage with us using the contact information here.

Overview

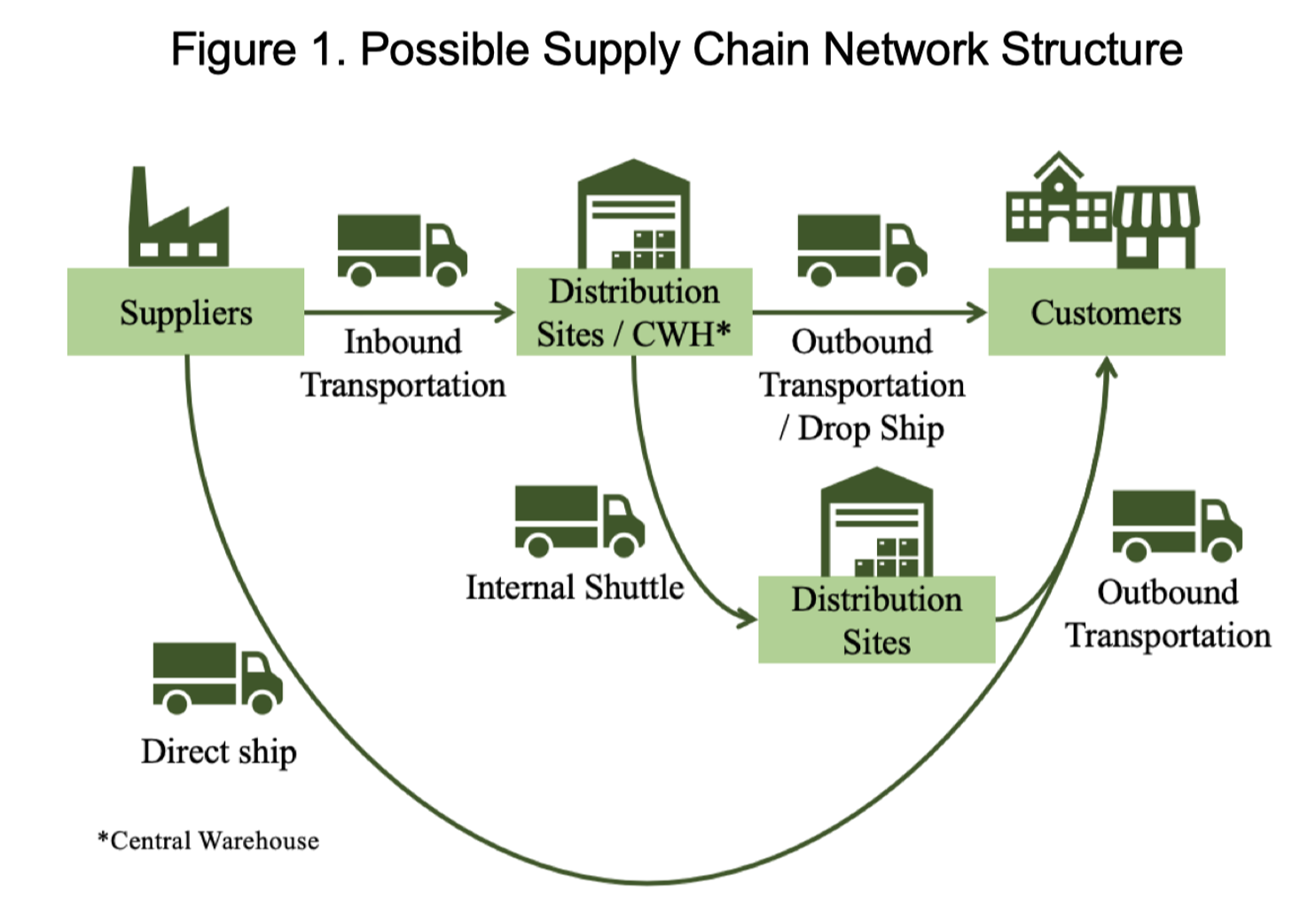

These challenges include the need for better coordination between trading partners, more complex logistics networks that support and integrate multiple distribution channels and delivery models, as well as high consumer expectations for the convenience and reliability of delivery services.

We aim to help companies identify new capabilities and technologies that will unlock new opportunities for growth and efficiency in omnichannel distribution networks. The core areas of expertise we bring to this work include fulfillment strategies, trends in warehouse automation, omnichannel returns, and the role of AI in omnichannel and e-commerce.

The questions driving our current research include:

- What are the forces shaping the future of online retail?

- What are the key challenges in omnichannel and e-commerce (e.g. fulfillment strategies, trends in warehouse automation)?

- How can companies better manage omnichannel returns?

- How is AI impacting omnichannel and e-commerce strategies?

- What are the potential vulnerabilities in highly automated warehouses?

Current State and Future Trends

Including an annual survey conducted in partnership with DC Velocity and CSCMP that examines the forces shaping retailers’ omnichannel fulfillment strategies.

Highlights

AI in omnichannel retailing: A revolution in the making

In the ever-evolving omnichannel landscape, consumers seamlessly transition among online and offline channels, requiring retailers to provide a unified experience across channels. Having re-engineered their supply chains to meet this challenge, retailers are now deploying artificial intelligence (AI) to take omnichannel retailing to the next level.

A recent survey conducted by the Omnichannel Supply Chain Lab examined where AI-driven innovations are having the most impact on omnichannel fulfillment. Not surprisingly, respondents ranked demand forecasting as the top domain affected by AI, followed by customer experience, customer service and chatbots, and inventory management. However, AI has a critically important role to play in transforming all the areas ranked, such as warehousing and returns management. Let’s delve into these different roles.

Read more in Supply Chain Xchange.

How AI will revolutionize supply chains

Recently, a panel of experts convened to discuss the convergence of AI and supply chains as part of Fast Company and Inc.’s AI Bootcamp series, in partnership with SAP, a leader in resource planning software series. The conversation explored AI’s potential for building more robust supply chains, as well as the challenges companies need to consider as they lean on technology to maximize efficiency and procurement efforts. Here are four takeaways from that conversation.

“One of the most common reasons I have seen companies fail when implementing disruptive technologies like AI is when they are rushing, with a lack of clear vision,” says Dr. Eva Ponce.

Highlighted in MIT News with the full story in Fast Company.

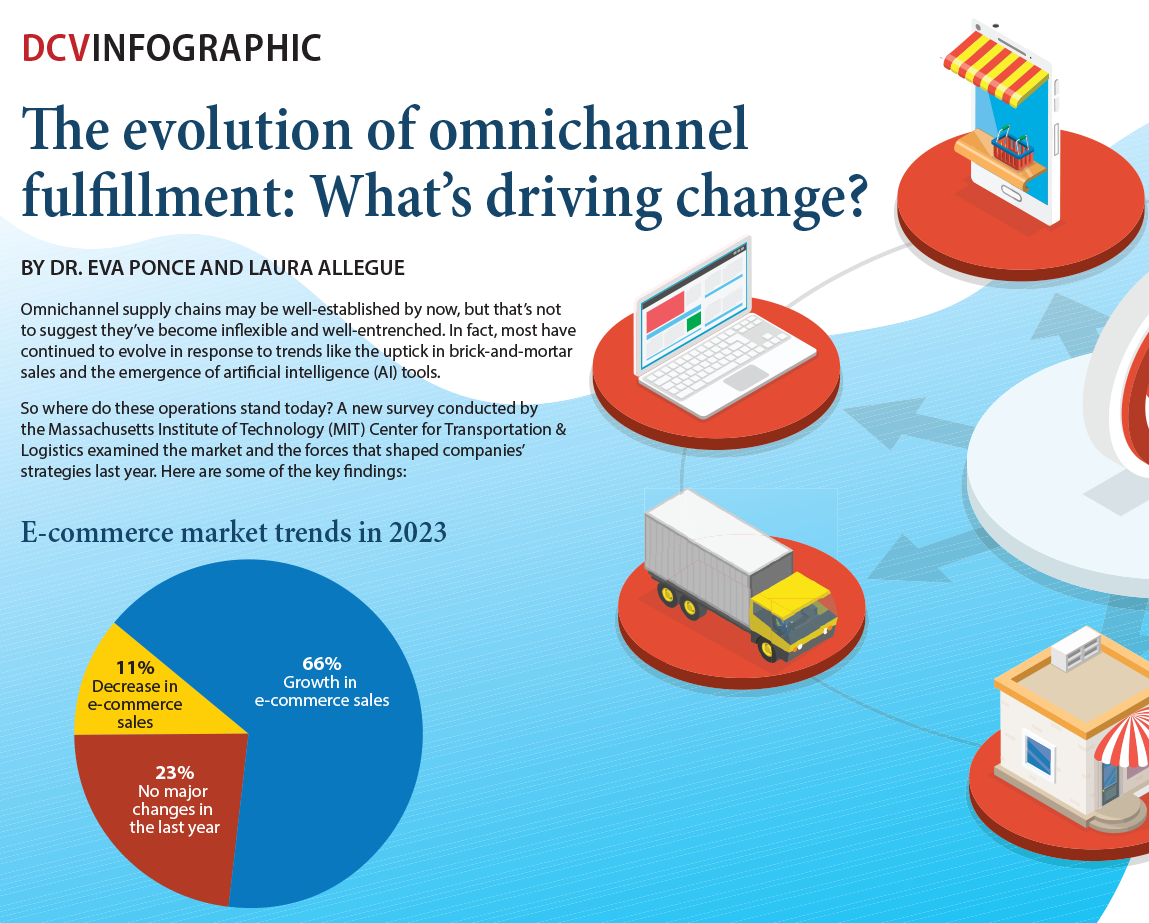

2023: What’s driving evolution of omnichannel fulfillment?

Omnichannel supply chains may be well-established by now, but that’s not to suggest they’ve become inflexible and well-entrenched. In fact, most have continued to evolve in response to trends like the uptick in brick-and-mortar sales and the emergence of artificial intelligence (Al) tools.

So where do these operations stand today? A new survey conducted by the Massachusetts Institute of Technology (MIT) Center for Transportation & Logistics examined the market and the forces that shaped companies’ strategies last year.

Read more in DC Velocity.

Six defining challenges of omnichannel fulfillment

Based on our research of omnichannel supply chains, including an online survey conducted in partnership with DC Velocity, we have identified six omnichannel fulfillment challenges that companies must address in order to be successful in today’s continually changing retail space. The answer in many cases, we believe, will involve adopting innovative technology and processes.

Read more in Supply Chain Quarterly.

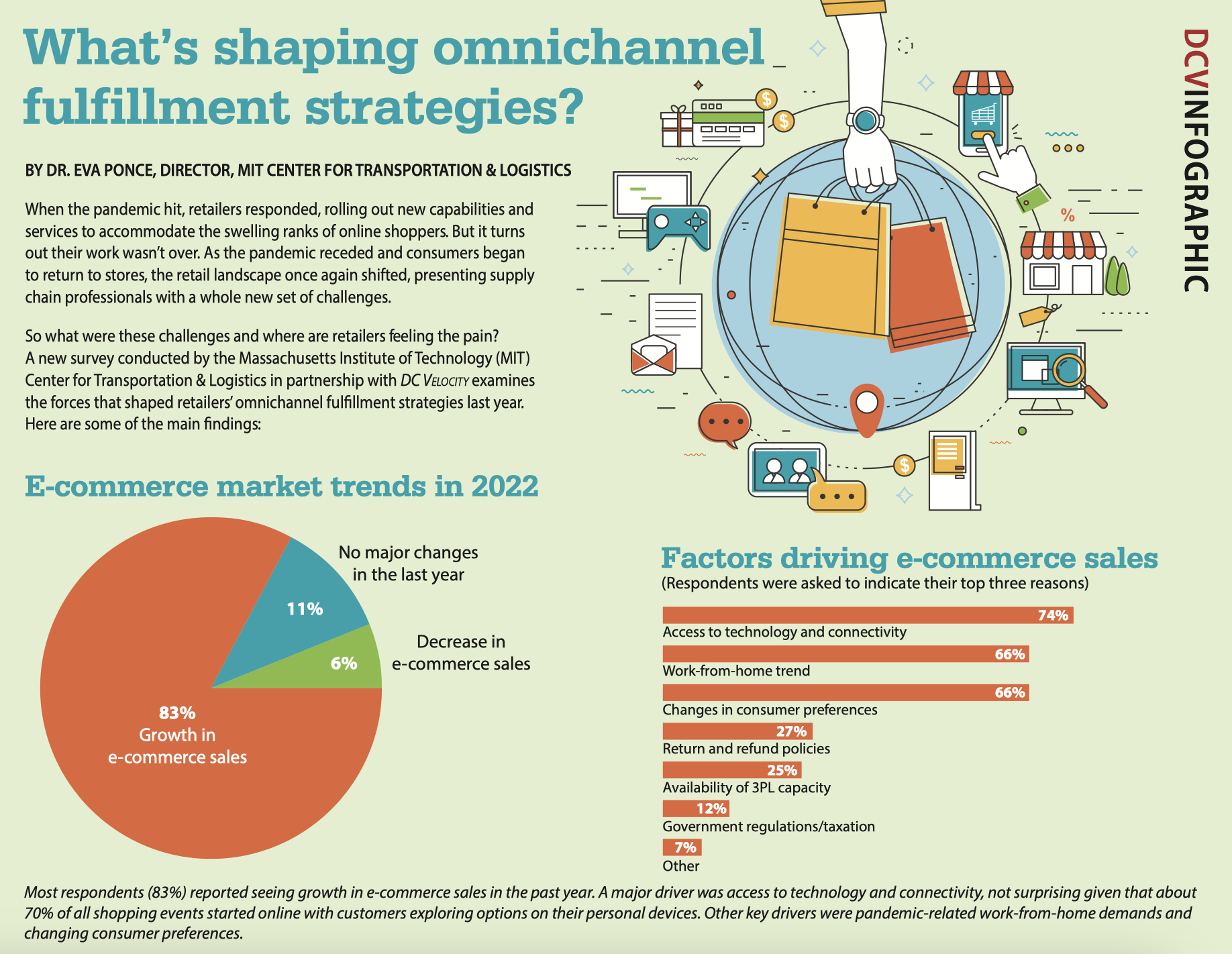

2022: What's shaping omnichannel fulfillment strategies?

As the pandemic receded and consumers began to return to stores, the retail landscape once again shifted, presenting supply chain professionals with a whole new set of challenges.

Read more in DC Velocity.

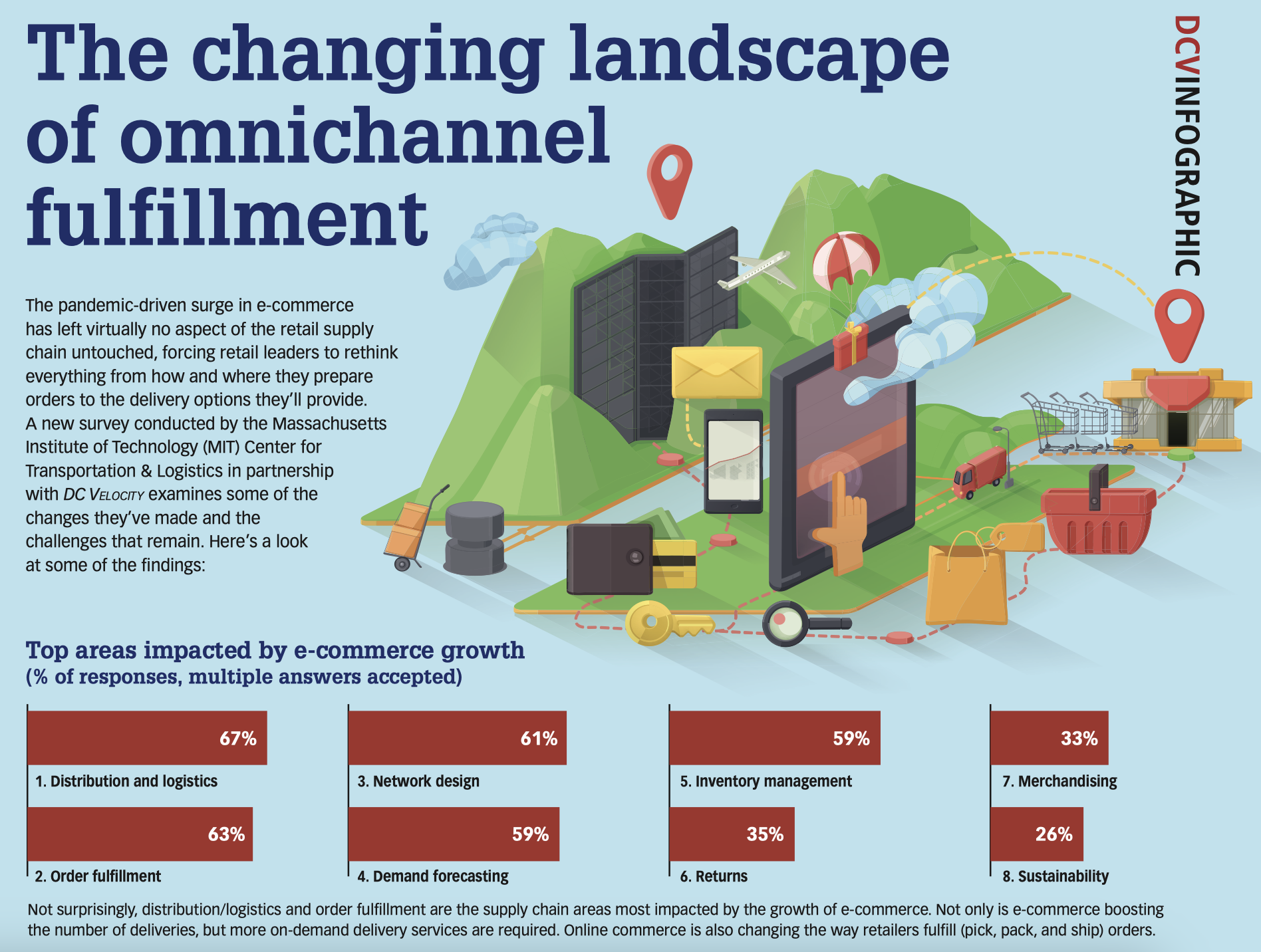

2021: The changing landscape of omnichannel fulfillment

The pandemic-driven surge in e-commerce has left virtually no aspect of the retail supply chain untouched, forcing retail leaders to rethink everything from how and where they prepare orders to the delivery options they’ll provide.

Read more in DC Velocity.

Network Design and Innovation

Leveraging brick-and-mortar for e-commerce | Channel integration | E-fulfillment strategies

Highlights

E-fulfillment cost management in omnichannel retailing: An exploratory study

- Different e-fulfillment strategies significantly alter the composition of e-fulfillment costs.

- The cost of e-fulfillment activities is poorly controlled except for the last-mile and picking.

- Most OC retailers don’t know the cost of fulfilling a specific online order (cost-to-serve).

- Accurate e-fulfillment cost data is correlated with using online-dedicated fulfillment centers (FCs).

- OC retailers change e-fulfillment strategies without knowing the true costs.

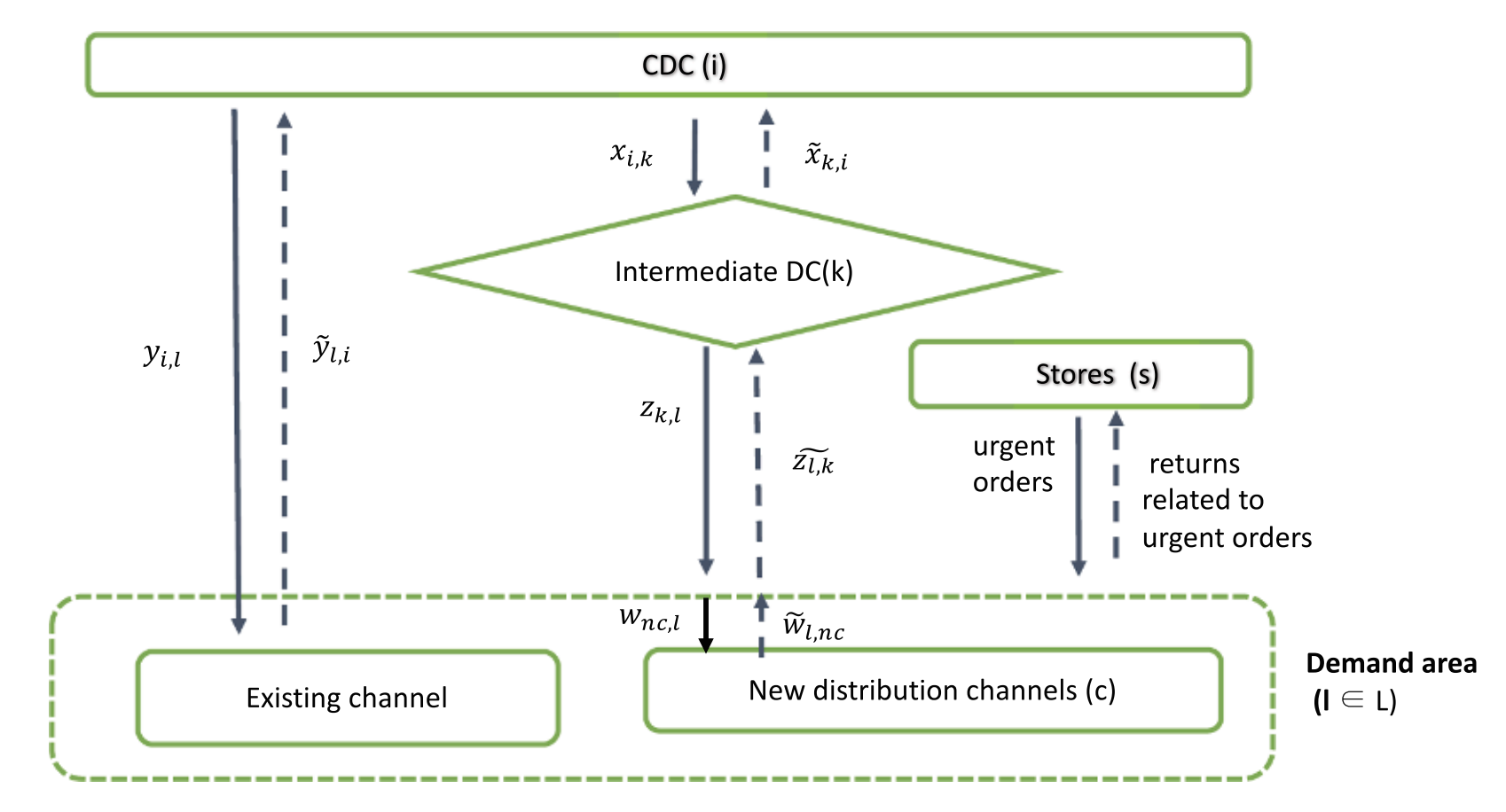

B2B Omnichannel Network Design and Inventory Positioning

A large U.S. foodservice distribution company, aims to minimize the overall cost for the supply chain network, including omnichannel fulfillment options. We built an MINLP model to simultaneously optimize network design and inventory positioning. Our results demonstrate potential cost reductions of 3–9% in transportation, 2–8% in warehouse handling, up to 50% in inventory costs, and nine times greater efficiency than Gurobi.

Fresh approaches to omni-channel in the grocery business

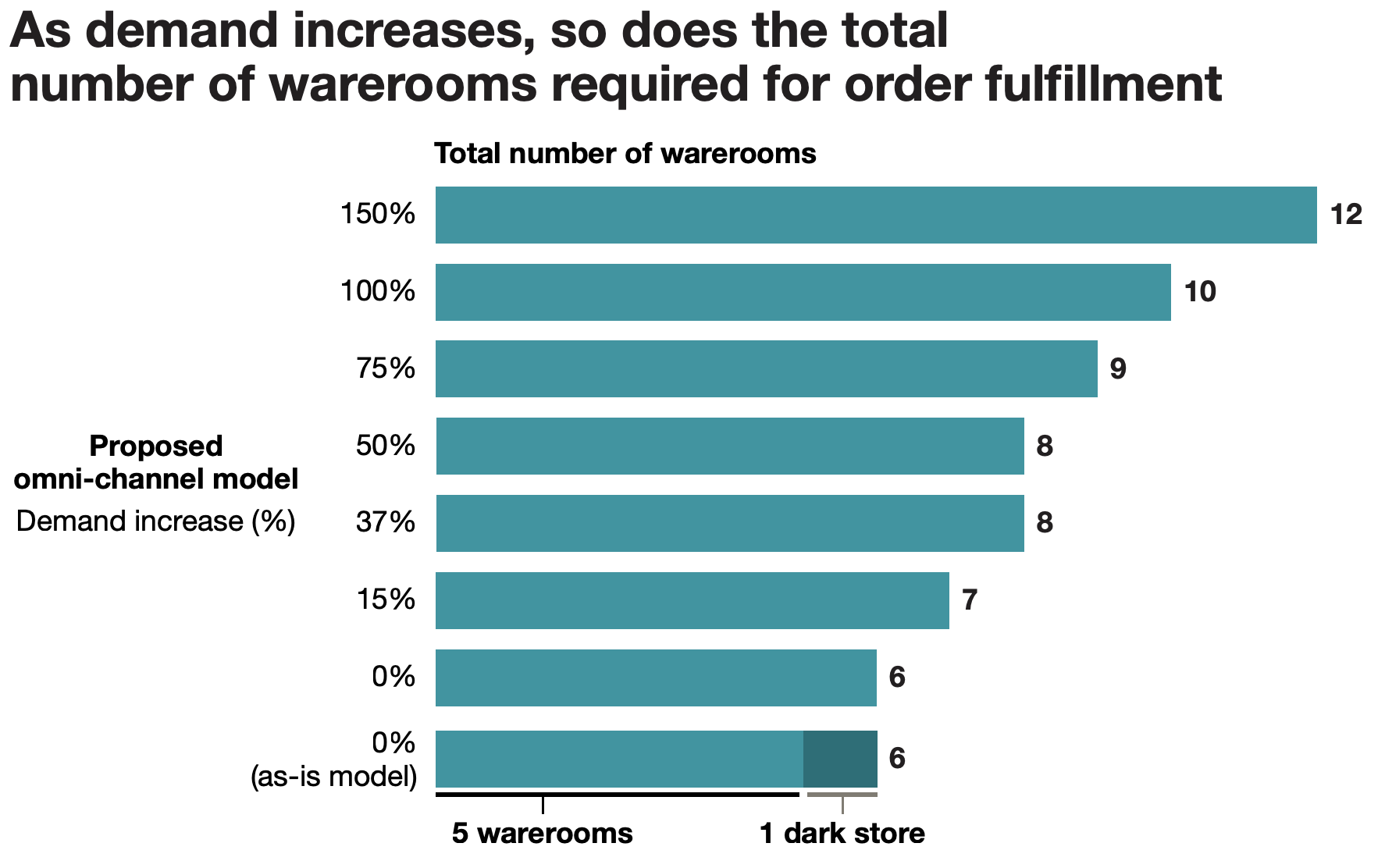

The innovative omnichannel supply chain models that have reshaped many parts of the retail industry continue to evolve in response to market changes. One of these changes is the increasing demand for grocery products ordered online, a trend reinforced by the COVID-19 pandemic that imposed restrictions on the use of physical stores for grocery shopping.

A challenge for traditional grocery retailers is how to develop omnichannel supply chains that support both online and offline

buying channels and deliver seamless customer service profitably.

Omnichannel logistics network design with integrated customer preference for deliveries and returns

This paper proposes a mixed integer program (MIP) for the network design problem of a parcel carrier that manages online orders from omnichannel retailers. The network includes several types of facilities, such as city distribution centers, intermediary depots, parcel offices, as well as collect channel points, such as automated parcel stations (APS), stores or kiosks. The model formulation takes into account the influence of these collection points on consumer choice and the maximum distance customers are willing to walk to reach them. Realistic transportation costs are also considered, including detailed long haul costs and delivery costs in an area… Finally, we use the model to discuss the network design of a Spanish parcel carrier operating in Madrid.

Warehouse of the Future

Crafting a vision for the next decade | Robotics and other advanced technologies | Risks and vulnerabilities

Highlights

The Warehouse of the Future: Toward Highly Automated, Interconnected, Sustainable Warehouses

The warehouse of the future represents a paradigm shift in warehouse design and operation. It is the industry’s response to the burgeoning growth of e-commerce, worldwide supply chain disruptions including warehouse labor shortages in developed markets, and increasing awareness of the significant volume of greenhouse gas (GHG) emissions emitted by warehouses.

In this white paper, we detail the concept and fundamental characteristics of the warehouse of the future: a shift toward a highly automated, interconnected system that leverages automation and digitalization to enhance precision, flexibility, and efficiency to adapt to changing market and supply chain trends, while integrating environmental sustainability alongside technological innovation. This concept signifies a forward-thinking model that aligns operational efficiency with a sustainable approach to warehousing, that is pivotal to the evolution of contemporary supply chains.

Potential Vulnerabilities in the Warehouses of the Future

Currently, we are exploring potential vulnerabilities in highly automated warehouses. The complex nature of new warehouse technologies, such as digital twins, drones, or collaborative robots, obscures potential weaknesses and since these systems are often interconnected, a disruption in a single facility could impact the entire supply chain, leading to significant losses in productivity and profits. Our goal is to identify potential vulnerabilities in emerging warehouse technologies and data management through cutting-edge research.

Why Micro Fulfillment Centers Are Here to Stay

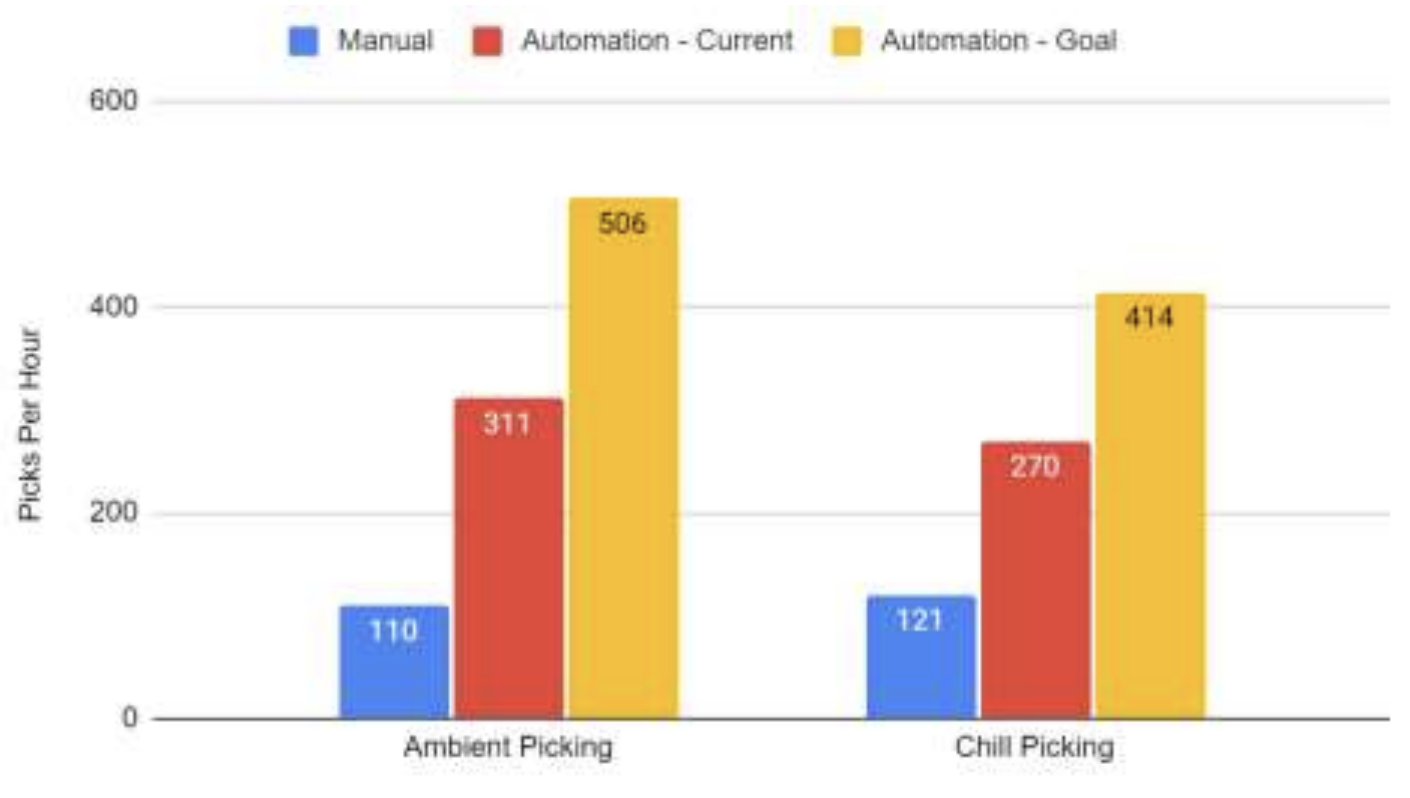

The Covid-19 pandemic has caused a rapid rise in e-Commerce order volumes. Consumers’ expectations for fast deliveries put pressure on omnichannel retailers to adopt new approaches to fulfilment. Consequently, the implementation of omnichannel fulfilment strategies has accelerated considerably. One of the formats being adopted is Micro Fulfillment centers (MFCs) – Is this model gaining the upper hand in a post-pandemic world’s supply chain?

The Warehouse of the Future for CPG Companies

Transforming Warehouses Towards a Sustainable Future

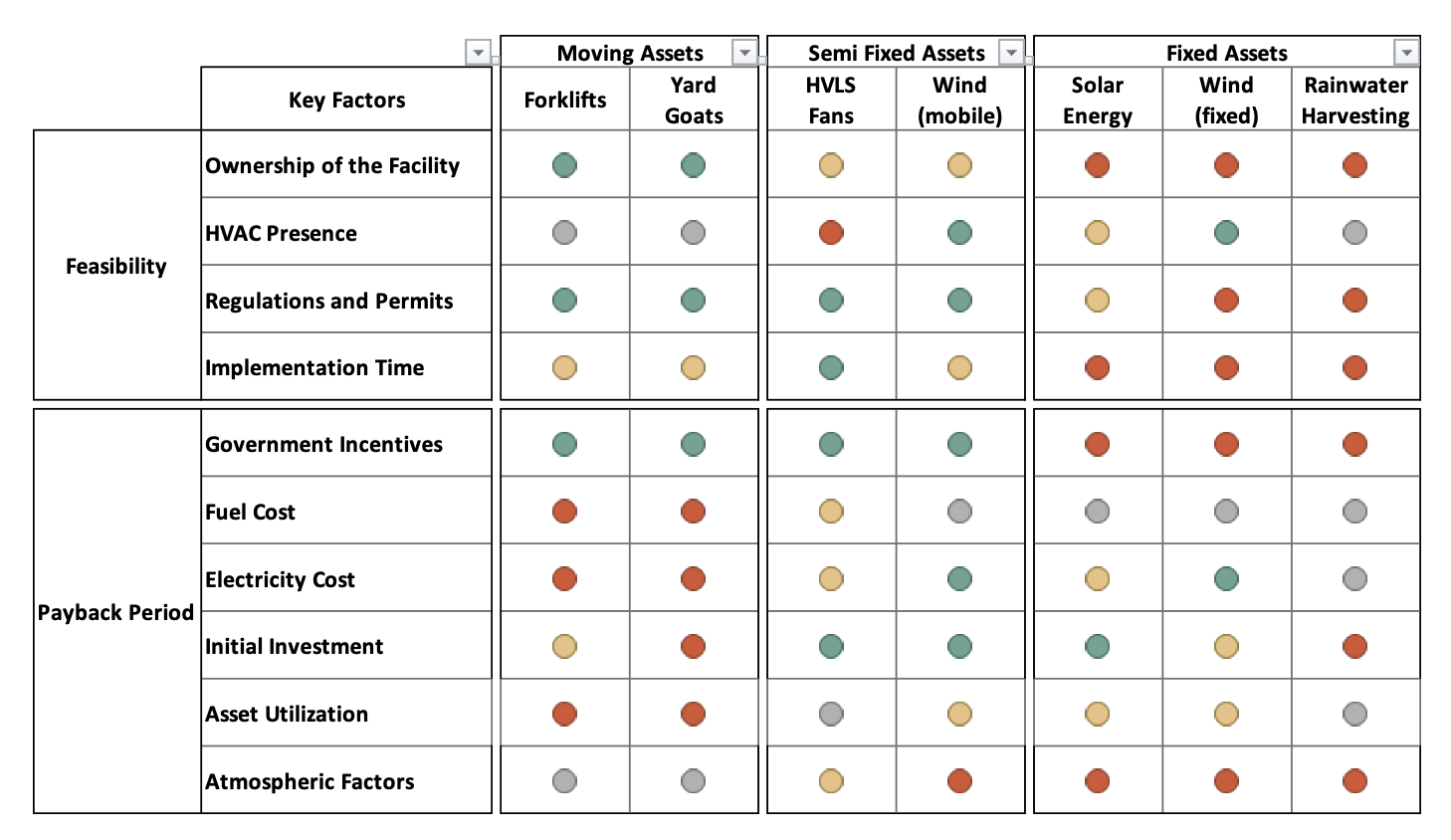

The warehousing industry is a significant source of greenhouse gas (GHG) emissions contributing to the climate change that is being witnessed by the world in the past few years. In response to that, our capstone sponsor Maersk tasked us with identifying actionable steps to reduce GHG emissions at the warehouse level. We evaluated 13 technologies to reduce GHG emissions and conducted an in-depth review of seven of them. Our methodology assessed the environmental and economic impacts of implementing these technologies. The project was concluded with a framework for evaluating different sustainable solutions in an integrated way.

Quantifying Warehouse Automation and Sustainability

Companies are embracing automation to help ease the pressure of the labor shortage in warehouses. At the same time, the energy consumption of automation equipment raises concerns of its environmental impact among investors, regulators, and customers alike. Although there are general greenhouse gas accounting standards, there is no comprehensive link between warehouse automation and emissions. This research proposes a framework for measuring greenhouse gas emissions stemming from warehouse automation. The result is a dynamic carbon emissions calculator that determines the total CO2 emissions derived from the energy consumption of various automation technologies. The framework is validated using real data from an e-commerce grocery retailer and provides results indicating that sustainability and automation are not mutually exclusive.

Other Research Tracks

Customer preferences and price incentives | Circular supply chain initiatives

Highlights

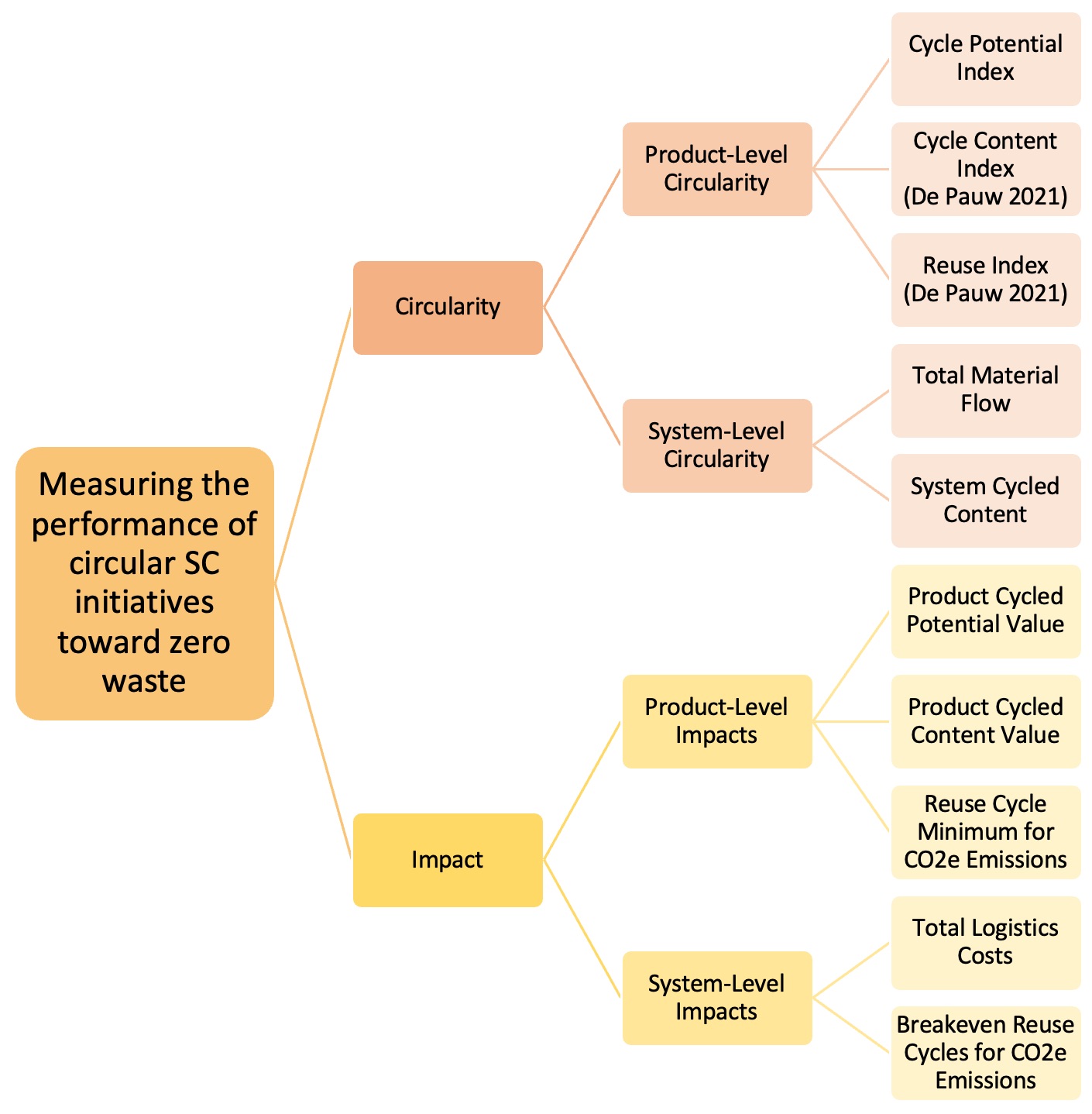

Measuring reusable packaging performance in omni-channel networks

Omnichannel supply chains in the retail industry have evolved rapidly over recent years in response to shifting consumer demands. At the same time, the shift toward circular economies is gaining momentum as countries and companies set increasingly ambitious sustainability goals. How can omnichannel support the development of circular supply chains?

One way is to create reverse flow channels that collect returned products and packaging for recycling and reuse. The retail industry is actively developing these reverse supply chains, and one of the challenges they face is how to measure the impact of reuse strategies on omnichannel operations.

Learn more about our recent research with a large, multinational retail company in the Supply Chain Management Review.

Key metrics to measure the performance and impact of reusable packaging in circular supply chains

Circular supply chains comprise the industrial production and supply chain systems used by companies to eliminate waste and recover value in products and materials. There are a variety of circular strategies including recycling in waste management, returns and repair in consumer-facing industries, and reusable packaging in supply chains. Successful implementation and management of these circular strategies requires the ability to measure and report on progress across different functions and processes. In this paper, we propose a new set of metrics to measure the performance of reusing items in a circular supply chain. We then demonstrate the use of the proposed metrics through a case study with an omnichannel retail company. This new set of metrics provides companies with a tool to measure and report on progress toward a circular economy. It also suggests future avenues for research to assess the economic, environmental, and social dimensions of sustainability.

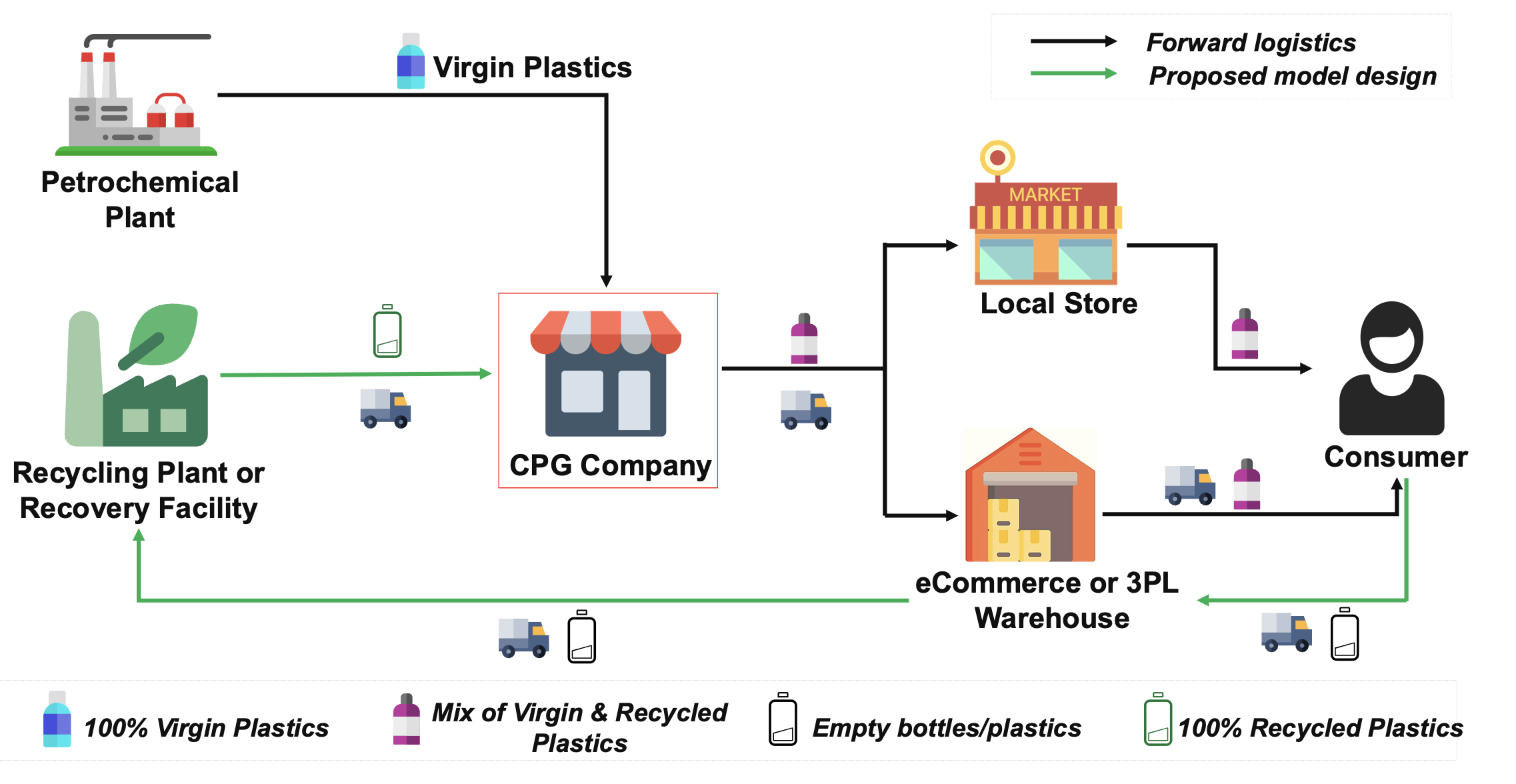

Get Smart: Reinventing Plastic Recycling in a Collaborative, Circular Supply Chain

Many CPG firms have publicly committed to source fractions of their plastic consumption from recycled plastic sources, but current quantities of recycled plastic are substantially less than what is required to meet these goals. To address this challenge, we evaluated three different types of circular supply chain networks, reliant on collaboration between material recovery facilities (MRFs) and Amazon last-mile delivery facilities (LMDs). The goal of this research is to determine the optimal network design that maximizes total system profit and quantifies the distribution of costs and profits of participating actors. To this end, we conducted a case study based in the State of New Jersey and compared network designs using mixed integer linear programming. We determined that the network with unconstrained selection of SMRFs was the most profitable, presenting positive annual net profits, and a robust network of one SMRF and six MRFs that were able to capture the supply of plastic entering the network. The results of this case study present the groundwork for further network evaluations and present an opportunity for collaboration between the CPG industry, Amazon, MRFs and SMRFs in the development of these circular supply chain networks.

+1 (617) 715-4169

1 Amherst Street

MIT Building E40-369

Cambridge, MA 02139

United States